What Is the Gross Profit Margin Formula? A Complete Guide for Business Health

In the world of business finance, few metrics are as fundamental and revealing as the Gross Profit Margin. It is the first true test of a company’s core production efficiency and pricing strategy, acting as a financial pulse check before other expenses enter the picture. While the concept seems simple—how much money is left after making a product—the depth of insight it provides is profound. This comprehensive guide will dissect the GP margin formula, moving beyond mere calculation to explore its critical role in financial analysis, strategic decision-making, and long-term business sustainability. Whether you’re a seasoned entrepreneur, a new manager, or a student of finance, mastering this formula is essential for diagnosing operational health and driving profitability.

Understanding the Core: What is Gross Profit?

Before diving into the margin, we must define its numerator: Gross Profit. Gross Profit represents the financial gain a company retains after deducting the direct costs associated with producing the goods or services it sells. These direct costs are collectively known as Cost of Goods Sold (COGS).

Think of it this way:

- Revenue: The total income from sales (Top Line).

- COGS: The direct cost to create those sold items (e.g., raw materials, direct labor, factory overhead).

- Gross Profit: The leftover money that must now cover all other expenses and, hopefully, provide a net profit.

Formula: Gross Profit = Total Revenue – Cost of Goods Sold (COGS)

The GP Margin Formula: From Dollar Amount to Percentage Power

The Gross Profit figure alone, while useful, lacks context. A $500,000 gross profit is impressive for a small bakery but insignificant for a multinational automaker. This is where the Gross Profit Margin Formula transforms an absolute number into a powerful, comparable percentage.

The Standard GP Margin Formula is:

Gross Profit Margin (%) = (Gross Profit / Total Revenue) × 100

Alternatively, it can be written in its expanded form:

Gross Profit Margin (%) = [(Revenue – COGS) / Revenue] × 100

This percentage tells you what portion of each dollar of revenue is retained as gross profit. For example, a GP margin of 40% means that for every $1.00 of revenue generated, the company retains $0.40 to cover operating expenses, taxes, interest, and net profit, after accounting for the direct production costs.

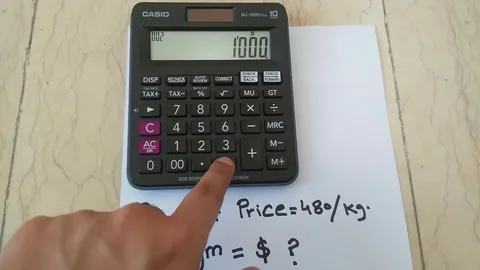

Step-by-Step Calculation Example

Let’s make this concrete with a hypothetical company, “Alpha Manufacturing.”

- Total Revenue (Fiscal Year): $2,000,000

- Cost of Goods Sold (COGS): $1,200,000 (includes raw materials, direct factory wages, manufacturing utilities)

Step 1: Calculate Gross Profit.

Gross Profit = $2,000,000 – $1,200,000 = $800,000

Step 2: Apply the GP Margin Formula.

GP Margin = ($800,000 / $2,000,000) × 100

GP Margin = (0.40) × 100 = 40%

Interpretation: Alpha Manufacturing retains $0.40 from every sales dollar as gross profit. The remaining $0.60 is consumed by the direct costs of production.

Decoding Cost of Goods Sold (COGS): The Critical Variable

The accuracy of your GP margin hinges entirely on a correct calculation of COGS. Misclassifying expenses here can severely distort your financial picture.

What’s INCLUDED in COGS?

- Direct Raw Materials: Lumber for a furniture maker, flour for a bakery.

- Direct Labor: Wages for assembly line workers or chefs directly making products.

- Manufacturing Overhead: Factory rent, utilities for production facilities, depreciation of manufacturing equipment.

- Freight & Shipping (inbound): Costs to get materials to the production site.

What’s EXCLUDED from COGS?

- Indirect Expenses: Rent for corporate offices, salaries for sales teams, marketing costs.

- Administrative Costs: Executive salaries, legal fees, accounting departments.

- Selling & Distribution: Advertising costs, outbound delivery to customer (often in operating expenses).

- Research & Development (R&D).

Why is the Gross Profit Margin So Crucial? Beyond the Calculation

This metric is a linchpin for internal management and external analysis for several key reasons.

1. Primary Indicator of Production Efficiency & Core Profitability

A stable or increasing GP margin suggests your company is effectively controlling its production costs or commanding higher prices. A declining margin signals rising production costs, pricing pressure, or product mix issues.

2. Essential for Pricing Strategy Validation

The margin directly reflects the success of your pricing. It answers: “Is our markup sufficient after accounting for the actual cost to produce?”

3. Enables Benchmarking & Competitive Analysis

Comparing your GP margin to industry averages (readily available from financial databases) reveals your competitive standing. Are you more or less efficient than your peers?

4. Foundation for Further Financial Analysis

Gross Profit Margin is the first step in the Profit Margin Hierarchy, feeding into:

- Operating Profit Margin (Gross Profit – Operating Expenses)

- Net Profit Margin (Gross Profit – All Expenses, Taxes, Interest)

Industry Benchmarks: Context is Everything

A “good” GP margin doesn’t exist in a vacuum; it is entirely industry-dependent.

- Software/SaaS Companies: Often have margins of 80%+ (low COGS—mainly server costs).

- Service Consultancies: Can range from 50-70% (COGS is primarily direct labor).

- Manufacturing: Typically 30-50%, depending on complexity.

- Retail/Groceries: Often very low, around 20-30% (high cost of purchased inventory).

- Restaurants: Generally 25-35% (high cost of food and direct labor).

Comparing a restaurant’s margin to a software company’s is meaningless. The key is to track your own trend and measure against your direct industry competitors.

Strategic Levers: How to Analyze and Improve Your GP Margin

A low or declining margin isn’t a death sentence; it’s a diagnostic tool. Improvement levers generally fall into two categories: Revenue Enhancement and Cost Control.

Revenue-Side Strategies

- Strategic Price Increases: Can you increase prices without losing significant volume? This often relies on brand strength and product differentiation.

- Product Mix Optimization: Focus on promoting and selling higher-margin items within your portfolio.

- Value-Added Services: Bundle products with services that have lower COGS to improve the overall transaction margin.

Cost-Side Strategies (COGS Reduction)

- Supplier Negotiation: Renegotiate contracts, seek bulk discounts, or source from more cost-effective suppliers.

- Production Efficiency: Invest in technology or lean manufacturing techniques to reduce labor hours and material waste.

- Inventory Management: Implement Just-In-Time (JIT) systems to reduce storage costs and obsolescence, which can be part of COGS.

- Product Redesign: Can the product be made with fewer or less expensive materials without sacrificing quality?

Common Pitfalls and Misconceptions to Avoid

- Confusing Margin with Markup: A 50% margin is not the same as a 50% markup. Markup is calculated on cost (Cost * (1+Markup%)), while margin is calculated on revenue.

- Inconsistent COGS Calculation: Changing your inventory accounting method (FIFO vs. LIFO) can dramatically alter COGS and thus your margin from period to period.

- Ignoring the Trend: A single period’s margin is a data point. The real story is in the multi-period trend. Is it heading up, down, or staying stable?

- Over-Optimization at the Expense of Quality: Slashing COGS by using inferior materials can boost margin in the short term but destroy brand reputation and sales in the long term.

Gross Margin in Action: A Comparative Case Study

Let’s examine two fictional retailers to see the story margins tell.

TechHub (Electronics Retailer):

- Revenue: $1,000,000

- COGS: $700,000

- GP Margin: 30%

BrewCraft (Specialty Coffee Retailer/Roaster):

- Revenue: $300,000

- COGS: $120,000

- GP Margin: 60%

Analysis: While TechHub has higher revenue, BrewCraft has a vastly superior gross profit margin. This indicates BrewCraft either has significant pricing power (brand, specialty product) or extremely efficient roasting/purchasing. TechHub operates in a competitive, low-margin sector. It must generate massive volume and tightly control operating expenses to achieve a healthy net profit.

Integrating GP Margin into Financial Models and Forecasting

Forward-looking businesses use the GP margin as a key driver in financial projections. By forecasting sales and applying a target GP margin percentage, you can estimate future gross profit, which then flows into cash flow forecasts and pro forma income statements. This is critical for budgeting, fundraising, and strategic planning.

Conclusion: The GP Margin as Your Financial Compass

The Gross Profit Margin formula is far more than a simple arithmetic exercise. It is a vital diagnostic tool, a benchmark for competitiveness, and a guidepost for strategic decision-making. By consistently and accurately calculating your GP margin, analyzing its trends, and understanding the industry context, you gain unparalleled insight into the core efficiency of your business operations. It highlights whether your fundamental business model—creating and selling a product or service—is sound before other complexities cloud the picture. Mastering this formula empowers you to make informed decisions on pricing, cost control, and product strategy, ultimately steering your business toward greater financial stability and growth.

Frequently Asked Questions (FAQs)

Q1: What is the difference between Gross Profit Margin and Net Profit Margin?

A: Gross Profit Margin measures profitability after direct production costs (COGS). Net Profit Margin measures profitability after all expenses are deducted, including operating expenses, taxes, and interest. It’s the final percentage of revenue that is actual net income.

Q2: Can a Gross Profit Margin be too high?

A: While generally positive, an exceptionally high margin could indicate a company is not reinvesting in quality, is overcharging customers (potentially risking future sales), or has a monopoly-like position. It can also attract competition. Context and sustainability are key.

Q3: How often should I calculate my GP margin?

A: At a minimum, calculate it monthly alongside your financial statements. For businesses with high transaction volumes or rapid changes, even weekly tracking can be beneficial for quick course correction.

Q4: What is a “good” Gross Profit Margin for a small business?

A: There’s no universal answer. A “good” margin is one that is at or above your industry average and sufficient to cover your operating expenses while leaving a desirable net profit. First, benchmark against your specific industry.

Q5: If my revenue is growing but my GP margin is shrinking, what does that mean?

A: This is a potential red flag. It suggests your cost of producing goods is rising faster than your sales prices. You may be discounting heavily or experiencing inflation in materials/labor without adjusting prices. This can lead to a “busy but broke” scenario.