Lifeline Insurance UAE | Expert Healthcare Claims Management

Transforming Healthcare Insurance Management in the United Arab Emirates

The healthcare insurance sector in the United Arab Emirates has witnessed remarkable transformation over the past decade, driven by technological innovation and growing demand for efficient administrative solutions. Modern policyholders expect seamless service delivery, transparent communication, and instant access to their coverage information. Meeting these expectations requires sophisticated third-party administration that combines medical expertise with cutting-edge technology platforms.

Healthcare management excellence begins with choosing the right administrative partner who understands regional requirements and delivers consistent quality across all service touchpoints. lifeline insurance uae has established itself as a trusted provider of comprehensive third-party administration services, offering integrated solutions that simplify the complex intersection of healthcare delivery and insurance coverage. Through innovative approaches and member-centric policies, quality healthcare administration becomes accessible to individuals, families, and organizations throughout the Emirates.

Third-party administration under Khat Al Haya Management of Health Insurance Claims LLC brings specialized expertise to insurance operations since its establishment in 2015. This dedicated healthcare administrator operates across three countries including the UAE, Oman, and Turkey, providing essential services such as claim settlement, record maintenance, policy administration, and provider network coordination. By partnering with leading insurance carriers and reinsurance companies, comprehensive risk management solutions protect policyholders while ensuring financial sustainability for insurance providers.

Streamlined Documentation and Reimbursement Procedures

Efficient claim submission represents a critical component of satisfactory insurance experience. The lifeline claim form provides a standardized template designed to capture all essential information required for prompt claim adjudication and reimbursement processing. This comprehensive document ensures that every claim contains necessary details including member identification, treatment information, provider credentials, and supporting medical documentation.

Proper completion of the lifeline claim form significantly impacts processing speed and approval rates. Each section of the form serves a specific purpose in the adjudication workflow, from verifying policy coverage to validating medical necessity and calculating benefit amounts. Members should carefully review form instructions, gather all required supporting documents, and ensure accuracy in every field before submission to avoid unnecessary delays or requests for additional information.

Digital accessibility has revolutionized how members interact with the lifeline claim form system. Online platforms enable instant form downloads, electronic completion, digital signature capabilities, and secure document uploads without requiring physical paperwork or office visits. This modernized approach reduces processing cycles from weeks to days while providing real-time visibility into claim status through integrated tracking systems.

Healthcare providers benefit from standardized lifeline claim form protocols that create consistency across all reimbursement requests. The uniform structure facilitates automated data extraction, reduces manual review requirements, and accelerates payment cycles for medical facilities and practitioners. Clear coding guidelines and documentation requirements minimize claim rejections and resubmission needs, improving cash flow for provider networks.

Secure Digital Access to Comprehensive Policy Information

Digital transformation has revolutionized policyholder engagement through secure online platforms that deliver 24/7 access to critical insurance information. The lifeline portal login gateway provides members with immediate entry to personalized dashboards containing coverage summaries, utilization histories, network directories, and wellness resources. This centralized digital hub empowers informed healthcare decisions and proactive benefits management.

Registration for lifeline portal login credentials follows a simple verification process that confirms member identity and establishes secure authentication protocols. Once activated, accounts provide instant access to real-time policy data, pending claim statuses, pre-authorization updates, coverage limit tracking, and downloadable policy documents. The intuitive interface ensures easy navigation for users of all technical proficiency levels.

Advanced security infrastructure protecting lifeline portal login systems implements multiple layers of protection including encrypted communications, multi-factor authentication, session timeouts, and continuous threat monitoring. These comprehensive safeguards ensure that sensitive medical and personal information remains confidential while complying with international privacy regulations and data protection standards.

Cross-device compatibility of the lifeline portal login platform enables consistent access whether members use desktop computers, laptops, tablets, or smartphones. Responsive design automatically adjusts interface elements for optimal viewing and functionality across different screen sizes, ensuring convenient access during medical appointments, work hours, or travel situations requiring immediate policy information.

Enhanced features available through lifeline portal login extend beyond basic information access to include electronic ID card generation, direct secure messaging with customer service teams, appointment coordination assistance, wellness program enrollment, health risk assessments, and educational resources. These value-added tools transform traditional insurance participation into engaged health management partnerships.

Comprehensive Network Solutions and Member Support

Modern third-party administration encompasses far more than basic claim processing functions. Comprehensive service portfolios include strategic network development, utilization review, medical necessity assessments, pre-authorization management, customer support operations, and analytical reporting that drives continuous service improvements. These integrated capabilities create seamless experiences from policy enrollment through claim settlement.

Extensive provider networks ensure convenient access to quality healthcare facilities across diverse geographical regions. Strategic contracting with hospitals, specialty clinics, pharmacies, diagnostic laboratories, and allied health providers creates cashless treatment options that eliminate upfront payment burdens. Members simply present insurance identification at network facilities to receive approved services without financial transactions at the point of care.

Round-the-clock customer service operations provide essential support for coverage inquiries, claim questions, emergency assistance, and general policy guidance. Multilingual representatives trained in insurance products, medical terminology, and customer service excellence ensure effective communication with diverse member populations. Multiple contact channels including phone, email, web chat, and social media accommodate individual communication preferences.

Innovation Through Advanced Technology Integration

Cutting-edge technology infrastructure drives operational excellence in modern healthcare administration. Intelligent claim processing systems employ sophisticated rule engines containing thousands of adjudication parameters that automatically evaluate submissions against policy provisions, medical necessity criteria, fee schedules, and treatment protocols. This automation handles the vast majority of claims without manual intervention, dramatically reducing processing times while improving consistency.

Predictive analytics platforms analyze vast datasets to identify trends, detect anomalies, prevent fraud, and optimize resource allocation. Machine learning algorithms continuously improve accuracy by learning from historical patterns and outcomes. These insights inform strategic decisions about network development, product design, fraud prevention, and operational efficiency improvements that benefit all stakeholders.

Mobile technology extends healthcare management capabilities directly to member smartphones through dedicated applications. GPS-enabled provider searches, document capture using device cameras, push notification alerts, telemedicine integration, and appointment scheduling create comprehensive mobile experiences that support modern lifestyles and expectations for instant digital access.

Quality Assurance and Fraud Prevention Initiatives

Maintaining insurance program integrity requires robust monitoring and control systems that identify inappropriate utilization and fraudulent activities. Sophisticated algorithms analyze billing patterns, treatment sequences, and provider behaviors to flag suspicious activities for detailed investigation. These protective measures ensure that premium rates remain affordable while maintaining comprehensive coverage availability for honest policyholders.

Continuous quality improvement programs evaluate every aspect of service delivery through member surveys, provider feedback, performance metrics, and independent audits. Regular assessments identify enhancement opportunities and track progress toward service excellence goals. This commitment to ongoing improvement drives innovations that elevate member satisfaction and operational efficiency.

Medical Expertise and Professional Development

Clinical expertise from qualified medical professionals spanning diverse specialties ensures accurate claim adjudication and appropriate care authorization decisions. These healthcare experts review complex cases, evaluate treatment appropriateness, coordinate specialist consultations, and ensure that approved services align with evidence-based medical standards and policy coverage provisions.

Ongoing professional development programs keep staff current with medical advancements, regulatory updates, insurance innovations, and best practices in customer service. Investments in team development translate directly into improved claim accuracy, faster processing, better member communications, and enhanced overall service quality across all organizational functions.

Transparency and Member Empowerment Through Education

Open communication and transparency characterize every member interaction throughout the insurance lifecycle. Clear policy documentation, straightforward coverage explanations, honest limitation disclosures, and detailed claim status updates ensure members understand their benefits and rights. This transparency builds trust and reduces frustration associated with insurance complexity.

Comprehensive member education initiatives help policyholders maximize benefit utilization and make informed healthcare choices. Orientation programs explain coverage details, demonstrate digital tools, review claim procedures, introduce wellness opportunities, and answer common questions. Well-informed members experience greater satisfaction and better health outcomes through optimal benefits usage.

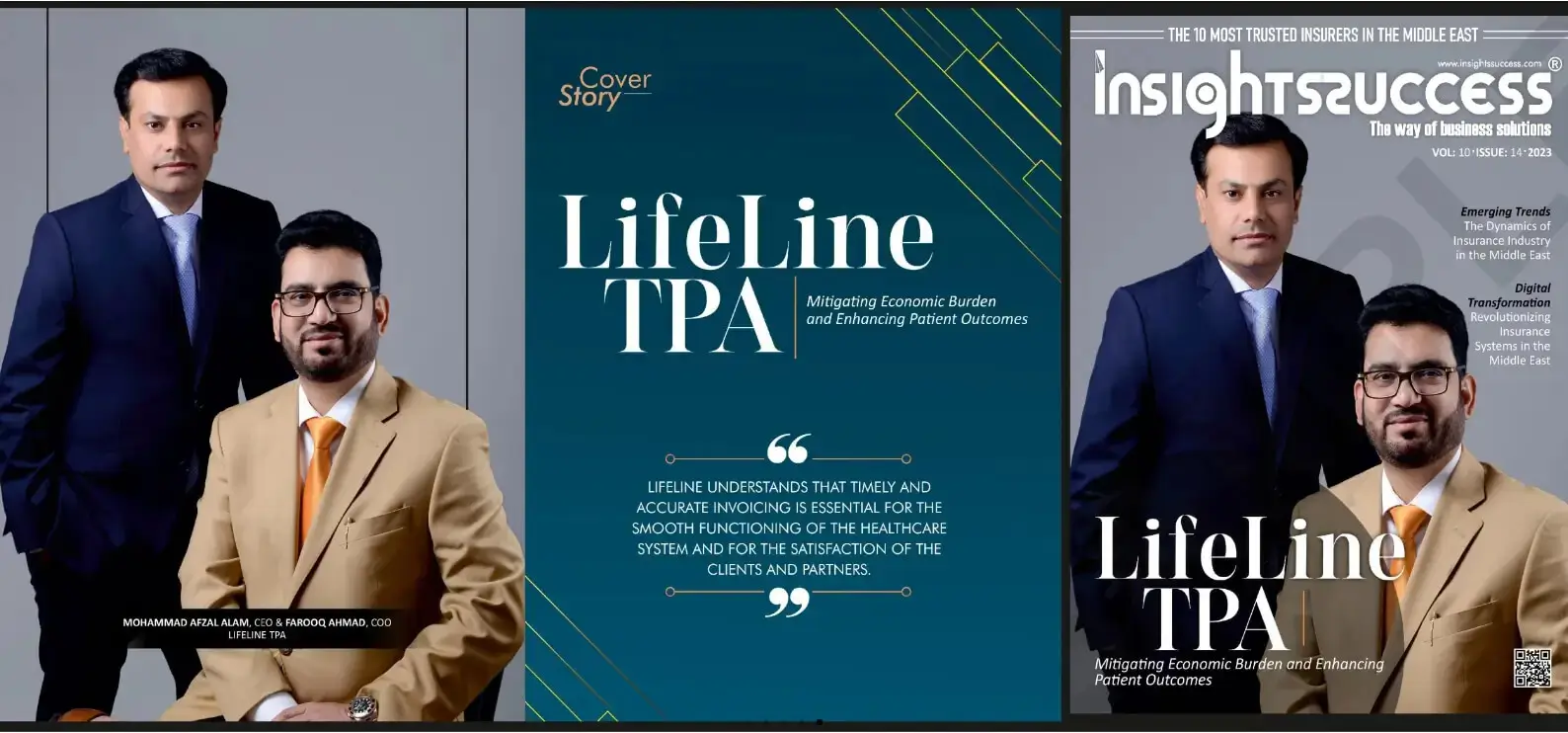

Visionary Leadership in Healthcare Administration

lifeline tpa continues expanding its proven service model with a vision to deliver exceptional third-party administration services globally. This ambitious growth strategy maintains the quality standards, technological innovation, customer-centric philosophy, and operational excellence that have driven regional success. Through strategic partnerships, continuous improvement, and unwavering commitment to member satisfaction, the organization positions itself as a leader in healthcare administration throughout the Middle East and beyond.