HankoX Review: Can a $10 Deposit Actually Get You Anywhere in Trading?

Most online brokers make grand promises about democratizing finance, then slap you with a $500 minimum deposit and hidden fees. HankoX flips that script—you can open an account with ten bucks and start trading forex, crypto, or commodities the same day.

Sounds too good to be true, right? That’s what I thought too.

But after digging into how HankoX structures its pricing, platform, and account tiers, there’s more substance here than the typical discount broker hustle. Let’s see if it holds up.

The Core Question: What Problem Does HankoX Solve?

Here’s the reality of retail trading in 2025: beginners get crushed by high entry costs and confusing platforms. Meanwhile, experienced traders pay bloated commissions to legacy brokers who haven’t innovated in a decade.

HankoX positions itself squarely in the middle—low enough barrier for new traders to experiment, tight enough spreads for professionals to execute without bleeding capital on fees.

The real test isn’t whether they claim this balance. It’s whether the platform architecture actually supports it.

Breaking Down the Account Structure

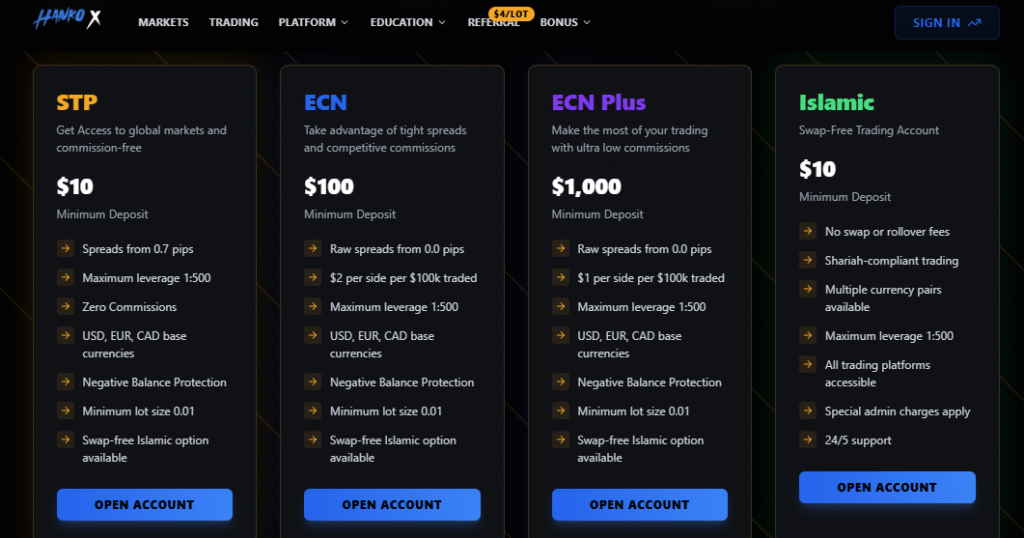

The $10 Question: Is the STP Account Real?

Yes, you can genuinely start with ten dollars. The STP (Straight Through Processing) account offers 0.7-pip spreads with zero commission and leverage up to 1:500.

Now, should you use 1:500 leverage on a $10 account? Absolutely not. But the point isn’t encouraging reckless risk—it’s removing the financial barrier that stops most people from ever trying. You can open positions, test strategies, and learn platform mechanics without the psychological weight of “I just deposited $500 and have no idea what I’m doing.”

For educational value alone, this tier makes sense.

ECN: Where the Math Starts Mattering

Once you understand basic trade execution, the ECN account becomes relevant. Raw spreads starting from 0.0 pips, $2 commission per side per lot, $100 minimum deposit.

Here’s why this matters: on a standard EUR/USD trade with 1.0 pip spread, you’re paying roughly $10 per lot. With HankoX’s ECN model, you’re paying $4 total ($2 in, $2 out) plus whatever the actual market spread is—often 0.1 to 0.3 pips during liquid sessions.

That difference compounds fast if you’re trading daily. Over 100 trades, you’re saving hundreds compared to spread-markup models.

ECN Plus: Built for People Who Trade Like It’s a Job

The ECN Plus tier drops commissions to $1 per side. If you’re executing 20+ lots per day, this is where HankoX becomes genuinely cheap.

Most brokers don’t offer this level of volume-based pricing until you’re moving institutional capital. HankoX sets the bar at $1,000 minimum deposit. That’s accessible for serious retail traders without requiring hedge fund-level commitment.

The Islamic Account Situation

Swap-free accounts are notoriously hard to find without strings attached. HankoX offers them across all tiers with identical pricing—no hidden fees, no trade duration limits, no markup games.

If you need Shariah-compliant trading, this is straightforward enough to actually use.

Register today and enjoy smooth trading environment at HankoX

The Platform: Why Build Your Own Instead of Using MetaTrader?

Here’s the honest take: most proprietary platforms are worse than MetaTrader. Clunky interfaces, missing tools, or just thinly disguised white-label software.

HankoX’s platform doesn’t fall into that trap. It’s not trying to reinvent charting—it’s trying to streamline execution. You get 100+ indicators, customizable workspaces, one-click trading, and integrated risk calculators without the bloat of plugins or third-party extensions.

The advantage? Everything loads faster. Order execution feels tighter. You’re not wrestling with software that was designed in 2005.

For traders who don’t need every obscure MetaTrader plugin, this works. For MT4 purists, it won’t.

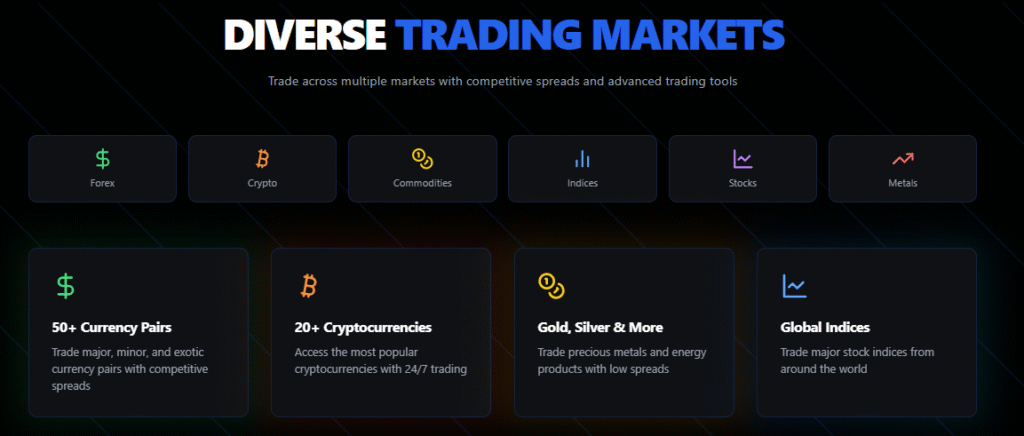

Asset Coverage: Broad Enough Without Pointless Filler

HankoX covers forex (50+ pairs), crypto (20+ tokens), commodities, indices, and stock CFDs. That’s wide enough to diversify or hedge positions without opening multiple brokerage accounts.

What they don’t do is pad the list with illiquid exotics nobody trades. You won’t find 200 forex pairs where 180 have 15-pip spreads and zero liquidity. The focus is on assets people actually want exposure to.

Cost Transparency: Where HankoX Competes Hard

Let’s compare apples to apples. On a standard lot EUR/USD trade:

Typical spread-markup broker: 1.5 pips = ~$15 cost

HankoX STP: 0.7 pips = ~$7 cost

HankoX ECN: 0.0 pips + $4 commission = $4 + minimal spread

HankoX ECN Plus: 0.0 pips + $2 commission = $2 + minimal spread

For scalpers or algorithmic traders executing hundreds of trades monthly, that cost difference is the margin between profit and break-even.

The Funding Reality: Crypto Changes the Game

Traditional forex brokers still treat crypto like a novelty. HankoX integrates it natively—deposits and withdrawals in BTC, ETH, USDT process within hours, not days.

If you’re already holding crypto, you’re not converting to fiat, waiting for bank transfers, or dealing with intermediary fees. You deposit, trade, withdraw. Done.

For international traders dealing with restrictive banking systems, this flexibility matters more than most marketing features.

Security Without the Regulatory Safety Net

Here’s where things get nuanced. HankoX isn’t regulated by FCA, ASIC, or other top-tier authorities. That’s a legitimate concern for risk-averse traders.

What they do offer:

- Segregated client funds (your money stays separate from operational capital)

- AES-256 encryption

- Two-factor authentication

- Negative balance protection

Is this equivalent to FCA regulation? No. Does it provide reasonable protection for retail traders managing moderate capital? Yes.

If you’re depositing six figures, you probably want FCA coverage. If you’re trading with $500 to $5,000, these protections are workable.

Copy Trading: Useful or Just Marketing?

Copy trading features often devolve into follow-the-whale schemes where beginners lose money mimicking traders with completely different risk profiles.

HankoX’s implementation includes adjustable risk controls and real-time synchronization. You’re not blindly copying—you’re choosing position sizing relative to your account.

Does this guarantee profitability? Obviously not. But it’s structured well enough to learn from without automatically replicating trades you don’t understand.

The Community Angle: Discord as a Competitive Advantage

A 10,000-member Discord might sound like noise, but active trading communities provide real value—shared analysis, strategy discussions, and rapid answers to platform-specific questions.

HankoX uses this better than most brokers. Instead of outsourcing support entirely, they embed community channels alongside official help. You get answers from both experienced traders and platform reps.

For new traders, this beats scrolling through FAQ pages hoping to find relevant info.

Bonuses and Referrals: Read the Fine Print

The 100% deposit bonus doubles your capital instantly. Sounds great until you realize volume requirements before withdrawal. These bonuses are useful for increasing position sizes while learning—not for padding your withdrawal balance.

The $4-per-lot referral program makes sense if you produce content or have trading networks. Otherwise, it’s not relevant to most users.

Who Actually Benefits From HankoX?

This broker works for:

- New traders who want to start small and scale naturally

- Active day traders or scalpers focused on cost per trade

- Crypto-native traders who prefer fast deposits/withdrawals

- Traders needing swap-free Islamic accounts

- People who value community support over corporate customer service

This broker doesn’t work for:

- Conservative investors requiring top-tier regulatory oversight

- MetaTrader loyalists who won’t consider alternatives

- Traders who prefer traditional bank-wire-only funding

Final Verdict: Is HankoX Worth Opening an Account?

HankoX isn’t competing with IG Group or Saxo Bank on brand recognition. It’s competing on cost structure and execution quality for traders who prioritize performance over prestige.

The $10 entry removes risk from exploration. The tiered pricing scales naturally with experience. The proprietary platform executes cleanly without unnecessary complexity.

Will it replace established brokers for everyone? No. But for traders who care more about spreads than logos, HankoX delivers where it counts.

Start with the STP account, test a few trades, withdraw once to confirm it works, then decide if it fits your strategy. That’s the smart approach with any broker—and HankoX’s low barrier makes it easy to verify before committing serious capital.