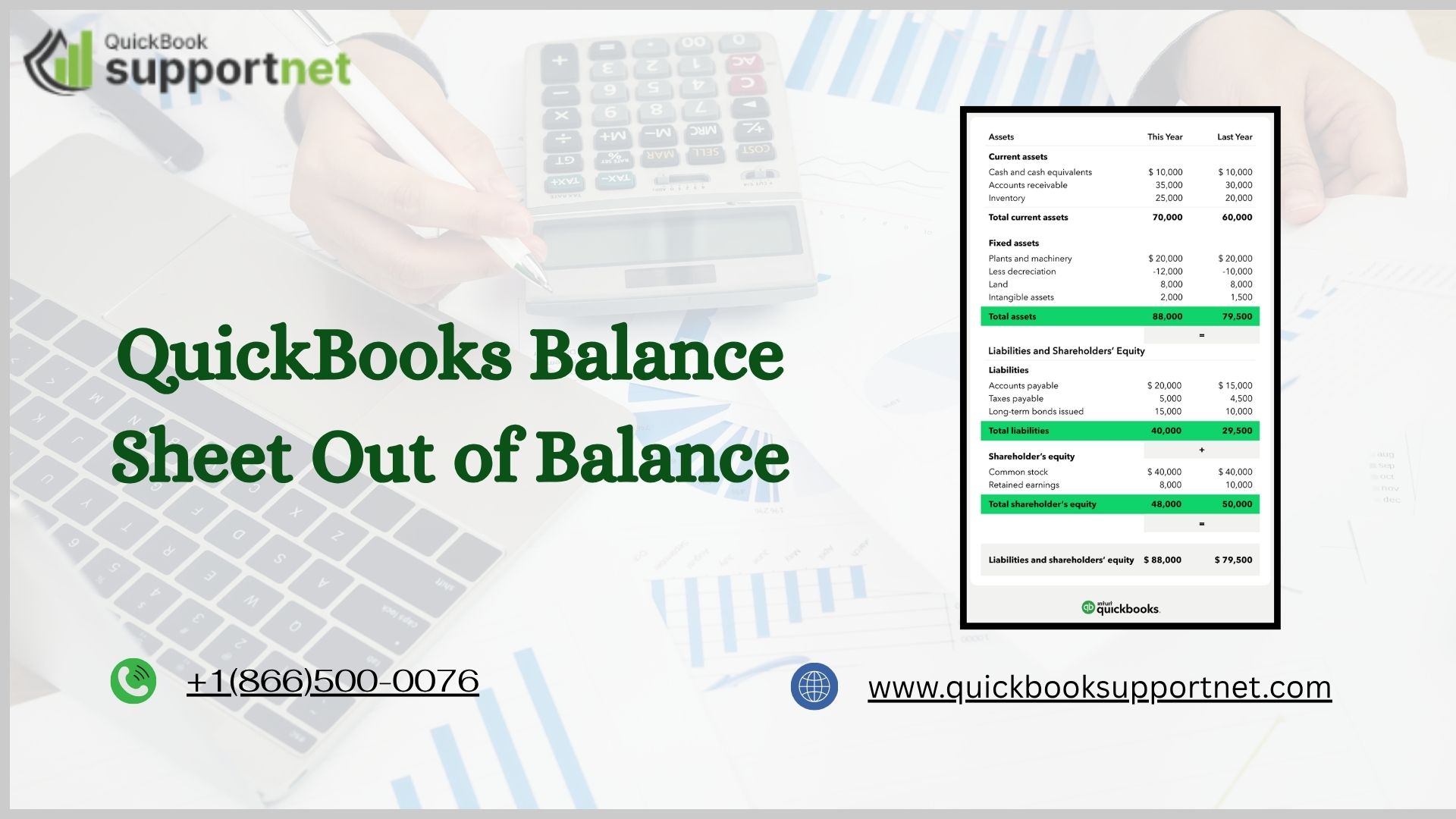

Fix QuickBooks Balance Sheet Out of Balance Easily

Accounting accuracy is critical for any business, and a QuickBooks balance sheet out of balance can create serious discrepancies in your financial reporting. When assets, liabilities, and equity don’t match, it can affect decision-making, payroll, and tax filings. Fortunately, QuickBooks provides tools and processes to troubleshoot and resolve these issues. If you encounter challenges during the process, QuickBooks support is available at +1(866)500-0076 for immediate assistance.

Resolve QuickBooks balance sheet out of balance issues with our expert guide for accurate financial reporting.

Why Does a Balance Sheet Go Out of Balance?

A balance sheet out of balance in QuickBooks usually occurs due to:

- Data Entry Errors: Mistyped amounts or posting transactions to incorrect accounts.

- Unreconciled Accounts: Bank or credit card accounts not reconciled properly.

- Deleted or Edited Transactions: Deleting invoices or bills without proper adjustments.

- Journal Entry Mistakes: Incorrect debits and credits in the general ledger.

- Payroll Adjustments: Improper payroll posting or adjustments affecting retained earnings.

Identifying the root cause is crucial for a clean and accurate balance sheet.

Step-by-Step Guide to Fix QuickBooks Balance Sheet Out of Balance

1. Verify Your Accounts

Start by reviewing your QuickBooks general ledger. Compare totals for assets, liabilities, and equity to detect discrepancies. Look for unusual amounts or entries that may be causing the imbalance.

2. Reconcile Your Accounts

Ensure all bank, credit card, and other accounts are reconciled. QuickBooks provides reconciliation tools to compare account statements with recorded transactions. Unreconciled transactions are a common cause of balance sheet errors.

3. Review Journal Entries

Go through all journal entries to check that every debit has a corresponding credit. Pay special attention to manual entries, as even small mistakes can throw the balance off.

4. Check for Deleted or Modified Transactions

Deleted or edited transactions can create mismatches. Use the audit trail report in QuickBooks to identify any changes and restore or correct them.

5. Use QuickBooks Balance Sheet Verification

QuickBooks has a built-in verification tool that scans your company file for issues. Run the “Verify Data” utility to detect errors, then use the “Rebuild Data” tool to automatically correct problems.

6. Investigate Payroll Adjustments

If you recently processed payroll, ensure all payroll liabilities and expenses are correctly posted. Incorrect payroll postings can affect retained earnings and the balance sheet total.

7. Compare Trial Balance Reports

Generate a trial balance report in QuickBooks and check whether debits and credits match. Differences here often point directly to the transactions causing the out-of-balance issue.

8. Seek Professional Help if Needed

If the discrepancy persists, it’s wise to contact a QuickBooks expert or accountant. QuickBooks support is available at +1(866)500-0076 to help troubleshoot complex balance sheet discrepancies.

Tips to Prevent Future Balance Sheet Errors

- Regular Reconciliation: Reconcile accounts monthly to catch errors early.

- Accurate Data Entry: Double-check amounts, account selection, and transaction dates.

- Audit Trail Reviews: Periodically review the audit trail for changes to critical transactions.

- Professional Oversight: Have an accountant or bookkeeper review complex transactions.

- Backup Data: Maintain regular backups to restore files in case of errors.

Benefits of Fixing an Out-of-Balance Balance Sheet

- Accurate Financial Reporting: Ensures assets, liabilities, and equity are correctly recorded.

- Better Decision Making: Reliable data allows informed business decisions.

- Compliance: Avoids discrepancies in tax filings and regulatory reports.

- Time Savings: Reduces the need for manual reconciliations and corrections.

- Peace of Mind: Confidence in your accounting data improves overall business management.

Conclusion

A QuickBooks balance sheet out of balance can be alarming, but it’s usually fixable with systematic troubleshooting. Start with reconciling accounts, verifying journal entries, and using QuickBooks’ verification and rebuild tools. Regular reviews, accurate data entry, and professional oversight can prevent future issues. For complex discrepancies or immediate assistance, contact QuickBooks support at +1(866)500-0076. Maintaining an accurate balance sheet ensures financial integrity, compliance, and better decision-making for your business.

FAQs

Q1: Why is my QuickBooks balance sheet out of balance?

Common causes include data entry errors, unreconciled accounts, deleted transactions, or incorrect journal entries.

Q2: How can I quickly identify the cause?

Run the audit trail report, verify data with QuickBooks’ tools, and compare your trial balance.

Q3: Can payroll affect my balance sheet?

Yes, improper payroll posting or adjustments can create discrepancies in retained earnings and liabilities.

Q4: Does QuickBooks have tools to fix balance sheet errors?

Yes, QuickBooks provides “Verify Data” and “Rebuild Data” utilities to detect and correct common issues.

Q5: Who can I contact for help if I can’t fix it myself?

You can call QuickBooks support at +1(866)500-0076 for expert guidance.

Read Also: QuickBooks Error PS033