Risk Management Tips for LuxAlgo Users

Introduction

Risk management is one of the most important skills every trader must master, regardless of experience level or strategy. Many traders who start using LuxAlgo for the first time also look for ways to reduce costs by applying a luxalgo promo code while unlocking the full range of premium features. In the first or second paragraph, it’s essential to emphasize that risk management is the foundation of consistent trading, whether using LuxAlgo’s signals, overlays, smart trails, or market structure tools. While LuxAlgo can significantly improve decision-making, no indicator—no matter how advanced—can replace a strong and disciplined risk management framework.

Trading becomes far more effective when LuxAlgo users combine its powerful insights with a structured plan for managing losses, position sizes, drawdowns, market volatility, and emotional reactions. In this article, we will explore the best risk management tips designed specifically for LuxAlgo users, helping you trade with greater confidence and discipline.

Why Risk Management Is Essential for LuxAlgo Users

LuxAlgo provides highly advanced tools like confirmation signals, smart trails, trend strength indicators, and volume concepts. However, indicators alone do not prevent losses. Markets can change rapidly, signals can fail, and unexpected volatility can turn profits into losses quickly. This is where risk management becomes crucial.

Key reasons LuxAlgo traders need risk control:

- Trading signals can fail in unexpected market conditions

- False breakouts occur even with confirmation features enabled

- Unexpected news events can reverse trends instantly

- Emotional decisions often happen without a risk plan

- Long-term profitability relies on protecting your capital

LuxAlgo enhances accuracy, but risk management ensures longevity.

Setting Clear Stop-Loss Levels Using LuxAlgo Tools

One of the biggest advantages LuxAlgo offers is the ability to automatically place dynamic stop-loss levels using its Smart Trail feature. This tool adjusts dynamically as the market moves, giving traders a visual and strategic guide to exiting trades safely.

How to choose stop losses:

- Place stops below recent swing lows for long positions

- Place stops above recent swing highs for short positions

- Use Smart Trail to automatically manage stop placement

- Avoid placing stops too tight during volatile sessions

- Keep stops consistent with the timeframe you are trading

LuxAlgo users benefit greatly from blending manual stop-loss rules with smart, AI-driven trailing systems.

Position Sizing for LuxAlgo Signals

Proper position sizing determines how much you risk per trade. Even with strong indicators, too large of a position can ruin an account quickly.

Best practices for position sizing:

- Risk no more than 1–2% of your account balance per trade

- Reduce size during high volatility

- Use the Average True Range (ATR) to determine distance-based sizing

- Increase size only after consistent winning periods

- Avoid risking more on “high confidence” trades—confidence doesn’t equal success

LuxAlgo signals often look powerful, but discipline in position sizing ensures you can survive inevitable losing streaks.

Avoiding Overtrading with LuxAlgo

Because LuxAlgo provides precise, visually appealing signals, many traders fall into the trap of overtrading. Every signal looks tempting—but not all signals are high probability.

How to avoid overtrading:

- Trade only when multiple confirmations align

- Disable signals on low-volume timeframes

- Stick to a maximum of 2–4 high-quality trades per session

- Avoid using too many LuxAlgo overlays at once

- Never chase price after a missed signal

LuxAlgo is most effective when used selectively, not impulsively.

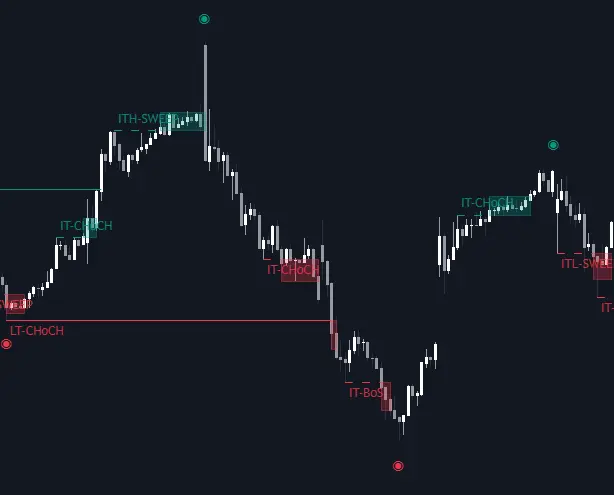

Using Multi-Timeframe Analysis for Risk Control

LuxAlgo’s multi-timeframe overlays and confirmation settings allow traders to scan the market with improved accuracy.

Why multi-timeframe analysis matters:

- Higher timeframe trends filter out bad signals

- Lower timeframe noise decreases significantly

- You gain a clearer picture of institutional vs. retail movement

How to apply it:

- Check trend structure on the 4H chart even if trading 15-minute signals

- Look for confirmation on multiple timeframes

- Avoid trades when higher timeframe structure contradicts lower timeframe signals

Higher timeframe alignment reduces risk dramatically.

Key Risk Management Points (Middle of Content)

Here are essential risk management principles LuxAlgo users should always follow:

- Never rely solely on one indicator

- Keep stop-losses consistent and preplanned

- Avoid trading during major news events

- Use multi-timeframe confirmation for safer entries

- Stick to strict position sizing rules

- Do not increase size to “win back losses”

- Avoid emotional trading after losing streaks

- Backtest your LuxAlgo strategy before risking real money

- Limit the number of trades taken each day

- Track performance in a trading journal

Following these principles consistently can help LuxAlgo users grow their accounts safely.

Emotional Discipline and Psychology for LuxAlgo Users

Trading psychology is often overlooked, but LuxAlgo users must stay disciplined, especially when signals appear frequently.

Key psychological tips:

- Never treat LuxAlgo signals as guaranteed

- Accept losses as natural and unavoidable

- Do not revenge trade after a losing position

- Stay patient—wait for high-probability setups

- Practice meditation or relaxation techniques before trading

A calm mind interprets indicators far more accurately than an emotional one.

Using LuxAlgo Confirmation Mode for Safer Trades

Confirmation mode filters out weaker signals and strengthens high-quality setups. Traders who focus on safety should consider enabling this setting.

Benefits:

- Fewer false signals

- Better trend continuation entries

- Clearer reversal confirmations

- Reduced risk during choppy markets

When combined with multi-timeframe analysis and strict stop-loss rules, Confirmation Mode becomes a powerful risk management tool.

Avoiding Trading During High Volatility Events

Even strong indicators like LuxAlgo can struggle during unexpected news events.

Tips for avoiding high-risk situations:

- Check economic calendars daily

- Avoid trading during CPI, NFP, FOMC, or earnings announcements

- Reduce position size during uncertain market conditions

- Wait for market stabilization before entering new trades

Even the best signals can fail during extreme volatility.

Backtesting LuxAlgo Risk Rules

Before applying risk management rules in live markets, traders must test their setups through backtesting.

What to analyze:

- Win/loss ratio

- Maximum drawdown

- Average risk-to-reward ratio

- Optimal stop-loss distance

- Performance across multiple market conditions

Backtesting ensures your risk rules work consistently.

Conclusion

LuxAlgo is a powerful trading tool, but its real strength emerges when users combine it with disciplined and well-structured risk management. By using smart stops, confirmation modes, proper position sizing, emotional discipline, and multi-timeframe analysis, traders can maximize profitability while minimizing unnecessary losses.

If you’re ready to improve your trading while securing access to premium features, you can start with a luxalgo promo code to reduce costs and begin enhancing your strategy with confidence.