HankoX Review 2025: The Zero-Spread Broker Traders Don’t Trust (But Maybe Should)

If you’ve traded long enough, you’ve probably noticed something: the market isn’t always your biggest enemy , your broker often is. Wide spreads that quietly drain profits, “commission-free” promises that hide bigger costs, and withdrawal requests that feel like pulling teeth. It’s no wonder traders roll their eyes whenever a new broker shows up claiming to be cheaper, faster, and fairer.

That’s the exact uphill battle facing HankoX, a forex and CFD broker making bold claims about zero spreads, commission-free accounts, and lightning-fast crypto withdrawals.

On paper, it looks like everything traders say they want. In reality, many are skeptical, and with good reason.

So, is HankoX just another slick marketing act, or could doubting it actually be costing traders an edge?

What Sets HankoX Apart from Traditional Brokers

Unlike the big industry names who spend millions on flashy ads and gimmicky bonuses, HankoX has carved out a different identity. Its entire pitch boils down to one simple idea: cut costs for traders and keep the platform lean.

That means no unnecessary frills, no oversized product menus, and no “free gadget” promos that get baked into your spreads anyway. Instead, HankoX puts its focus on:

- Tight execution for scalpers and high-frequency traders.

- Flexible account types that suit both beginners and pros.

- Simple, crypto-friendly payment methods that don’t leave you waiting days for a withdrawal.

For some traders, this “bare-bones but efficient” style feels refreshing. For others, it raises suspicion, after all, how many brokers have we seen promise the world, only to disappoint once you’ve funded your account?

The Zero-Spread Question: Hype or Reality?

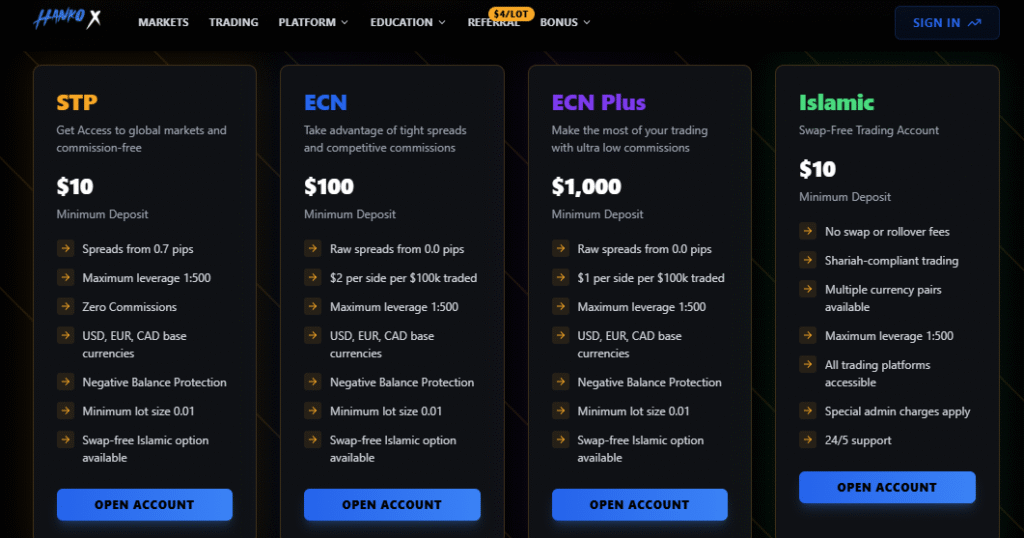

One of HankoX’s boldest claims is its zero-spread ECN account. It sounds like fantasy, spreads at 0.0 pips on pairs like EUR/USD and USD/JPY. And the truth is, it’s not a permanent condition. Spreads fluctuate with market liquidity, so during quieter hours, they widen just like anywhere else.

But when liquidity is high, you really can trade at razor-thin levels. Instead of widening spreads to cover costs, HankoX charges a flat $2 commission per side per lot, which works out to $4 per round-turn. For scalpers and intraday traders who rack up dozens of trades a session, this setup can save serious money compared to brokers who bake their profits into wider spreads.

For high-volume traders, the broker also offers an ECN Plus account, cutting commissions in half to just $1 per side. The catch? It’s only available if you hit specific trading thresholds. For professionals, though, that discount can make a big difference.

Open your account here and enjoy 100% deposit bonus.

Commission-Free Accounts: Free Isn’t Really Free

For traders who don’t rack up hundreds of trades a week, HankoX also offers a commission-free STP account. At first glance, it looks like free trading. But of course, the costs are baked into the spread. In this case, spreads start at 0.7 pips on major pairs, a competitive level compared to other brokers advertising “free” accounts that often widen spreads to 2–3 pips.

With a minimum deposit of just $10, the STP account is built for casual traders and beginners. It’s not the lowest-cost setup in the world, but it is refreshingly transparent. You know exactly what you’re paying for, without hidden inactivity charges or random swap markups.

Platforms: MT4 vs HankoX’s Own Suite

When it comes to execution, HankoX gives traders two very different options.

- MetaTrader 4 (MT4): Still the most popular trading platform worldwide. It’s reliable, widely supported, and perfect for anyone who runs Expert Advisors or relies on custom indicators.

- HankoX Proprietary Platform: A modern alternative designed for speed and simplicity. It offers advanced charting, one-click trading, an integrated economic calendar, and portfolio risk metrics. Beginners will appreciate the clean interface, while seasoned traders can streamline their setups without lag.

Having both choices is unusual for a broker in this price bracket, and it’s part of what makes HankoX more versatile than skeptics expect.

Assets You Can Actually Use

Some brokers overwhelm you with thousands of obscure trading instruments that few people ever touch. HankoX takes a different approach, offering a broad but practical selection:

- 50+ forex pairs across majors, minors, and exotics.

- 20+ crypto pairs including BTC, ETH, XRP, ADA, and LTC.

- Commodities like gold, oil, and natural gas.

- Indices including US30, NASDAQ, FTSE100, DAX, and Nikkei.

- CFDs on stocks and metals for extra diversification.

It’s enough to build a diverse portfolio, without drowning in a cluttered product menu.

Deposits and Withdrawals: How Fast Is HankoX With Your Money?

Funding and withdrawing money is often where brokers reveal their true colors. Delayed withdrawals, surprise fees, and restrictive minimums have burned traders more times than we can count.

HankoX aims to solve this by offering crypto-friendly deposits and withdrawals alongside traditional fiat methods. Supported options include Bitcoin, Ethereum, USDT, debit/credit cards, and bank transfers.

- Processing time: 24–48 hours for fiat; near-instant for crypto.

- Fees: No internal processing charges, though blockchain network fees still apply.

For crypto-savvy traders, this setup is a huge advantage, it avoids the banking bottlenecks that many traditional brokers still impose.

Copy Trading: Shortcut or Trap?

Another feature that makes HankoX stand out is its built-in copy trading system. This allows beginners to follow experienced traders and mirror their trades automatically. Performance rankings and risk settings give you some control over how much risk you’re taking on.

It can be a great way to learn by observation, but it’s not a magic bullet. Copy trading works best when you use it as an educational tool, not as a get-rich-quick shortcut. Trusting strangers with your capital always carries risk.

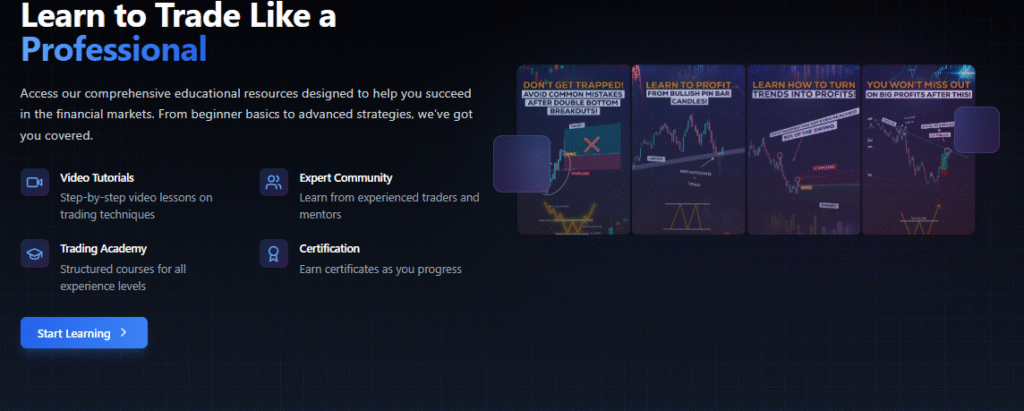

Education and Community: More Than Expected

Low-cost brokers rarely invest in trader education. HankoX does. It offers a Trading Academy, margin and pip calculators, eBooks, and even mentorship options through Discord.

That Discord community, now with over 10,000 traders , adds something most budget brokers don’t have: a real sense of connection. Traders swap strategies, market commentary, and sometimes just a little encouragement when a trade goes south. For many, this community is as valuable as the broker itself.

Regulation: The Elephant in the Room

No review of HankoX would be complete without addressing regulation. The broker is registered in St. Vincent and the Grenadines (SVG), a jurisdiction with limited oversight. It doesn’t carry the badges of trust that come with regulators like the UK’s FCA or Australia’s ASIC.

That said, HankoX does take security measures seriously, with AES-256 encryption, two-factor authentication, and segregated client accounts. For traders running small to mid-sized accounts, this may feel like enough. For those managing six-figure portfolios, it probably won’t.

The Bottom Line: Who Should Consider HankoX?

HankoX is not the right choice for every trader. If you’re looking for Tier-1 regulation, decades of track record, or brick-and-mortar offices in financial hubs, you won’t find that here.

But if your priority is tight pricing, fast crypto-friendly payments, and a platform that strips away the gimmicks, HankoX deserves a closer look. It’s especially appealing for:

- Beginners who want a low-cost way to start.

- Scalpers and high-frequency traders who rely on razor-thin spreads.

- Crypto-native traders who value instant deposits and withdrawals.

- Learners who want community support and copy trading as part of the package.

Skepticism is healthy in trading. But in this case, writing HankoX off too quickly might mean missing out on one of the most cost-efficient brokers available in 2025.